Supplemental pay refers to additional compensation provided to employees beyond their regular wages or salaries. It serves as an incentive and reward for extra work or exceptional performance.

Understanding supplemental pay and pay practices is essential for employers looking to motivate their workforce and employees seeking to maximize their earnings.

Background on Supplemental Pay

Supplemental pay has been a common practice for many years. It allows employers to remain competitive in attracting and retaining top talent.

Forms of supplemental pay include bonuses, commissions, overtime, and shift differentials.

With a tight labor market, supplemental pay has become increasingly popular.

Employers use it to incentivize productivity, performance, and loyalty.

Characteristics of Supplemental Pay

There are several key characteristics of supplemental pay:

- Performance-based – Tied to employee or company performance metrics. This motivates higher productivity.

- Incentivizes goals – Structured around specific goals or targets set by the employer. This focuses on employee efforts.

- Discretionary – Given at the employer’s discretion, unlike guaranteed salary and wages. This provides flexibility.

- Rewards effort – Acknowledges extra time, workload, or achievement beyond normal expectations. This boosts morale.

- Enhances retention – Helps retain top talent by providing additional compensation. This improves loyalty.

- Varies – Amount fluctuates based on changing performance and goals. This accommodates business needs.

- Temporary – Paid for a defined period, unlike ongoing salary. This contains costs.

- Taxable – Counts as taxable income, unlike some benefits. This impacts take-home pay.

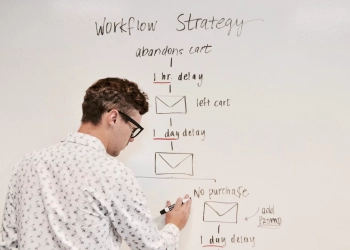

Calculating a Supplemental Pay Increase

When offering a supplemental pay increase, employers should follow these steps:

- Identify metrics that will be used to determine the amount (e.g., sales, profits, projects completed)

- Gather data on the employee’s performance on those metrics over a set time

- Compare the metrics to predetermined goals or targets for the review period

- Calculate the percentage that goals were achieved, exceeded, or missed

- Determine the percentage amount of pay increase aligned to that level of goal achievement

- Multiply the supplemental pay amount by the increase percentage to determine the new supplemental pay amount

Managing Supplemental Pay in 5 Steps

Effectively managing supplemental pay involves:

- Setting clear metrics – Establish quantifiable metrics for earning supplemental pay.

- Communicating expectations – Guide employees on how supplemental pay is earned.

- Tracking performance – Monitor employee performance on established metrics.

- Evaluating regularly – Assess supplemental pay eligibility at set intervals.

- Adjusting as needed – Tweak supplemental pay plans to optimize effectiveness.

Features, Benefits and Challenges

Key features of supplemental pay include performance-based, discretionary, and variable amounts.

Benefits are: drives productivity, rewards achievements, enhances retention, and aligns pay with results.

Challenges are perceived unfairness, complexity in administration, and uncertain motivation effects.

Examples of Supplemental Pay

Some common examples of supplemental pay are:

- Bonuses for meeting sales quotas, profit goals, or project milestones.

- Commissions based on sales volume or deals closed.

- Overtime pay for hourly employees working over 40 hours a week.

- Shift differentials for less desirable shift times or weekend work.

- Referral bonuses for bringing in new hires.

- Spot bonuses for noteworthy accomplishments.

Conclusion

Supplemental pay allows employers and human resource departments to incentivize, reward, and retain top talent while aligning pay with performance. It must be managed carefully through goal-setting, performance tracking, regular evaluation, and adjustment.

When structured appropriately, supplemental pay can benefit the organization and its employees.